How Much Money is Considered Wealthy?

I came across an interesting article from Bloomberg discussing the definition of being wealthy across different age groups. The data came from the 2019 Modern Wealth Survey from Charles Schwab. The online survey was based on answers from a cohort of 1,000 respondents, age ranged from 21 to 75 years old. Below are some interesting findings:

- 59% of Americans live paycheck to paycheck

- 44% of Americans carry credit card debt

- Only 38% of Americans have an emergency fund

- On average, Americans spend $500 on non-essential things

- 59% of Americans consider themselves to be savers

According to the survey, when asked if if they have $1 million dollars, what would they do?

- 54% would spend it on big ticket items such as a house, cars and travel

- 28% would like to pay off debt

- 23% will invest the money

- 21% opt to save the funds

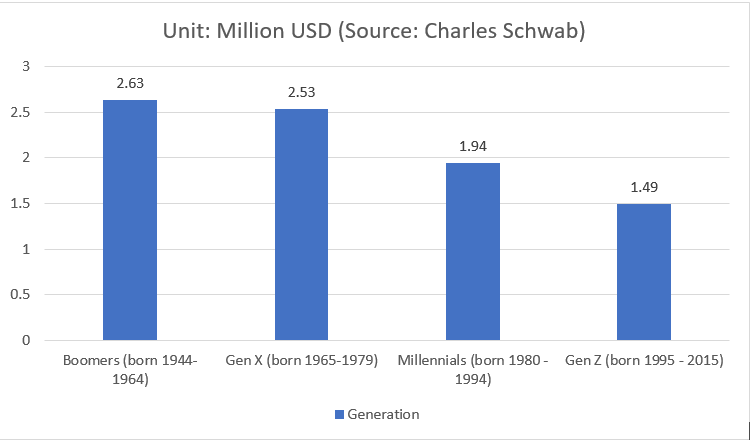

The definition of wealth is one of the central questions of the survey. According to the survey, on average, Americans define wealth as having more than $2.3 million dollars. However, when breaking down according to generations, there are different opinions on the definition of wealth.

Essentially, the older you get, the more money you think is needed to be wealthy.

Wealth Defined by Age Groups:

- Gen Z said it would take $1.49 million or more in net worth to be considered wealthy

- For Millennials, it takes $1.94 million to be considered wealthy

- Gen X defined wealth with a net worth of more than $2.53 million

- Baby Boomers thinks it takes $2.63 million to be rich

Unfortunately, a large portion of Americans don’t have that much money. According to the the latest Federal Reserve’s Survey of Consumer Finances, on average, the net-worth of most Americans fall in the range of $692,100 dollars.

Timeline for Becoming Wealthy:

When asked if they expected to become wealthy or are already wealthy at some point in their lifetime.

- 20% millennials

- 46% Gen X-ers

- 64% Baby Boomers

Said NO. While the rest are planning and plotting a course of action to increase their net worth and reach their wealth goals in the next 5, 10, or 25 years.

Overall, 60% of responders believe that they will become wealthy or already view themselves as wealthy in the next 25 years.

In Summary:

When it comes to wealth, there are no clear cut definition. You can use money as a determining factor but how much money is considered wealthy? This survey helped shed light on that fundamental question.

But is money the answer to everything? Some may say NO!

They might care more about their quality of life or their health.

Millennials for example, according to the same survey, value their experiences more than a certain monetary value.

Interestingly, the Schwab survey singled out the fear of missing out (FOMO) and social media as the reason for increased spending among Americans.

In essence, you’ve got to keep up with the Joneses right?

My Thoughts:

You have got to take care of yourself first. Your health comes first. If you don’t have good health, what good is your millions in net worth? Health care in the U.S. is expensive, you might have to spend all your money getting healthy again.

Do you want to know how much money does a pharmacist need to retire with? Read about it here.

The Schwab survey also pointed out that people with a good strategy and plan will have a higher probably of becoming wealthy than the rest.

These individuals are likely to save more, invest their money wisely, and have a good strategic outlook.

I have always thought a million dollars is a lot of money. And it is! But as I get older, one million doesn’t seem to be enough! My one million dollar goal might turn into two or three million. Who knows?

How much is enough for your retirement? What is your definition of wealth?

Pingback: Average Pharmacist Salary in 2019 - Pharmacist Money