What’s my Net Worth in May 2019?

What’s my net worth in May 2019? When I graduated from pharmacy school in 2011, I had a negative net worth of $218,000 with a combination of student loan and credit card debts! It has been a humbling experience clawing my way of that debt to having a net worth of $241,451 at the end of May 2019.

I was living paycheck to paycheck and was counting down the day when I could be debt free! If I had stayed the course I wouldn’t be debt free until 2023. I will make my last student loan payment at the end of July 2019 and I can’t wait!

Because of that and ignorance, I have not kept track of my net worth until May 2019. Net-worth is calculated by subtracting your liabilities from your assets.

Let’s take a look at my numbers, shall we? There are a variety of different ways you can keep track of your net worth. Google sheets have a template you can use.

Microsoft word has a net worth template you can use. Lastly, you can download and install the personal capital app and it will calculate your net worth for you every time you login.

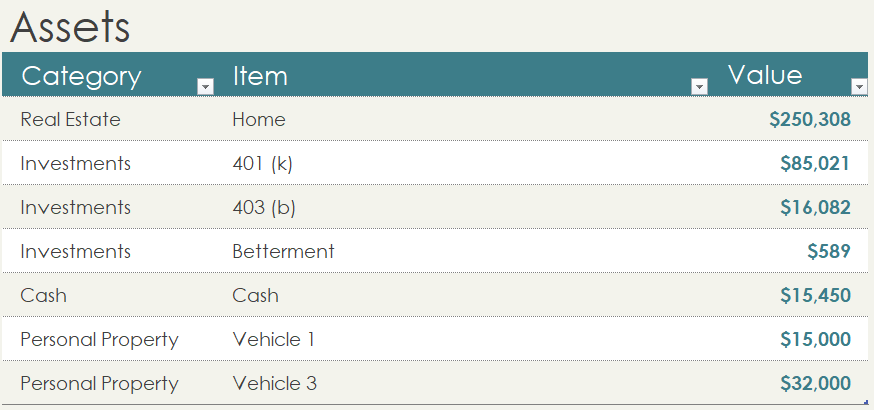

What are my Assets?

Some may argue that your primary residence is not an asset but rather an expense. I am going to treat my house as an asset for the purpose of calculating my assets.

My 403 (b) is fully vested and my company provides 5% matching. Overall, my 401 (k) and 403 (b) totaled $101, 103. Due to market fluctuations lately, my retirement account took a beating, my portfolio lost approximately $2,000 in May.

At this time of this writing, the value of the portfolio stabilized and regained some of its losses. The rule of thumb for 401 (k) and IRA investments is to not panic. The market will adjust itself over time, that’s why a fund’s performance is measured by their long term gains and not by their short term fluctuations.

The majority of my 401 (k) holding is on a tax-deferred status. Of note, I did not take full advantage of my employer match at the beginning of my employment. If I remember correctly, my 401 (k) plan was set up for me automatically and I was only contributing 3% pre-tax.

I scheduled my contribution to automatically increase by 1% until I max out my contribution, currently at $19,000 in 2019. Since then, I have manually adjusted my contribution and will begin to increase my contributions to reach the maximum allowed by the IRS for the first time for 2019.

I only started to fund my Betterment recently, I drained off my Betterment investments to pay down my student loan. I am now starting over with Betterment and will write a post regarding my experience with Betterment in the near future.

My real estate’s value is determined by Zestimate, a tool from Zillow.

The value of my cars are estimated from Kelly’s Blue Book.

My liquid cash is the sum of all of my checking and saving accounts.

What are my Liabilities?

The biggest liability I have right now is my mortgage. I want to pay it off as soon as possible.

I am debating the pros and cons of using a HELOC to pay off my mortgage versus just pay extra toward the principal i.e. bi-weekly payments, more on this in another post.

I currently owe around $12, 000 in student loans and will make the last payment in July. That day can’t come soon enough! I still have a car note, I initially wanted to pay that off as soon as possible but decided against it since the interest on my car loan is only 0.99% APR.

I bought the car brand new and are now starting to regret it. I will create a post about my financial mistakes and regrets at a later date.

What is my Net Worth?

Finally, we have arrived at the most important piece of information from this post.

I currently have a $241,451 net worth at the end of May 2019 (yay or nay?). Although, in my opinion, this is a respectable net worth for a person in my age group, however, according to the CNBC, the average net worth for an American in the age group of 34-44 is $288,700.

While it is good to know where I stand compared to peers in my age group, the beauty with personal finance is the fact that is it personal to you and your circumstances. Everyone’s situation is different, so it’s like comparing apples to oranges. I am happy with where I am right now and I am looking forward to watching my net worth grow over time.

Summary

One of my long term goal and a primary reason for creating this blog is to document the growth of my net worth and reach my goal of having a million dollars or greater in net worth and achieve financial freedom.

I believe that every pharmacist have the potential to reach a seven-figure net worth as long as you have a good plan and by making smart investment decisions sprinkled with a bit of luck.

I hope to increase the chances of reaching my goal by creating multiple income streams through a side hustle such as this blog, and other passive income streams.

At the same time, I will try to minimize lifestyle creep and utilize financial mistakes I learned from my own experiences and the experiences of others to pave the way.

It’s equally important to have the right mindset. For example, when I had over $188,000 in student loan, at one point I gave up and just let it be. I was hoping that if I set it and forget about it, in due time, my loan will be paid off.

That is the wrong mindset to be in, you have to be intentional in what you want. When I set my mind to it, I was able set a plan in action and am nearly at the end of my student loan journey.

Going forward, I am not to shy away from what I want. You have got to have that millionaire mindset and believe that you can do it in order to succeed.

Pingback: Rich Dad, Poor Dad by Robert T. Kiyosaki - Pharmacist Money

Pingback: Average net worth by age and August 2019 update - Pharmacist Money Blog

Pingback: December 2019 net worth update - Pharmacist Money Blog