Backdoor Roth IRA

What is a backdoor Roth IRA?

In today’s post, I will discuss my experiences with my first backdoor Roth IRA and a subsequent step-by-step guide.

In my opinion, Roth IRA is one of the most versatile tax-advantaged retirement account you can take advantage of today. If you’re interested, I discussed in more detail about Roth IRA in another post and you can read that here.

For the purpose of this post, the most important piece of information is contained in the below chart.

Roth IRA income and contribution limits for 2020

| Filing status | 2020 modified AGI | Maximum contribution |

|---|---|---|

| Married filing jointly or qualifying widow(er) | Less than $196,000 | $6,000 ($7,000 if 50 or older) |

| $196,000 to $205,999 | Contribution is reduced | |

| $206,000 or more | Not eligible | |

| Single, head of household or married filing separately (if you did not live with a spouse during the year) | Less than $124,000 | $6,000 ($7,000 if 50 or older) |

| $124,000 to $138,999 | Contribution is reduced | |

| $139,000 or more | Not eligible | |

| Married filing separately (if you lived with spouse at any time during the year) | Less than $10,000 | Contribution is reduced |

| $10,000 or more | Not eligible |

If you look at the chart above with an average pharmacist salary of around $126,120 you are ineligible to contribute to a Roth IRA.

Fortunately, there’s a tax loophole where you can open a traditional IRA and convert it to a Roth IRA. The whole process is called a “backdoor Roth IRA.”

You can open a backdoor Roth IRA plus a spousal Roth IRA for a total contribution of $12,000 each year with the current Roth IRA limitations.

There is another tool called the Mega Backdoor Roth IRA, if you’re eligible you’re welcome to do more research. This is beyond the topic of this post.

For more information on the advantages of a Roth IRA take a look at my article comparing Roth versus 401(k) here.

Backdoor Roth IRA with Vanguard

Vanguard is a big name when it comes to 401(k) programs. Before opening your brokerage account with Vanguard make sure you didn’t previously have an account with Vanguard.

Your account with Vanguard is still active even though you haven’t contributed anything to it for years.

The purpose of this guide is to help you navigate and prevent problems. I used The Physician’s Philosopher’s guide to help with my first backdoor Roth IRA conversion. I highly recommend you to use it as well here.

Nuances with Vanguard

Vanguard is a popular discount investment brokerage out there. You can choose to invest with Fidelity or Schwab, Vanguard’s main competitor in this arena.

When I wanted to open a Vanguard brokerage account, I had forgotten that my old employer used Vanguard to administer my 401 (k) account.

My current company uses Empower now so I thought that my old Vanguard account has been transferred over and closed.

Apparently, this is not the case.

Don’t forget about your old account. You’d think that it’s so old that it’s long been deactivated. Nope!

After numerous phone calls, I found out that my old Vanguard account only stayed in an idle state and NOT deactivated at all.

I first open a Vanguard account for my wife using her exact legal name.

This was a mistake, Vanguard will not inform you that you had an old account with them, instead, they will create a duplicate account and will hold your new account hostage until you provide documentation to verify that you are you.

After the verification process, the two accounts are merged.

Therefore, the following situations will have a potential problem if you create a new account with Vanguard and forgot about your old account.

- You legally changed your name.

- You changed your name because of marriage.

- Your name was entered incorrectly by your HR department.

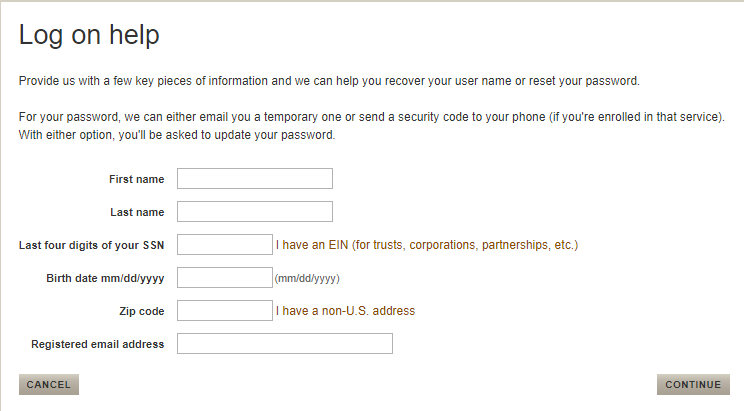

How do I fix this? The first step is simple, you will check to see if your name or any variations of your name is already associated with a Vanguard account BEFORE creating a new account.

You need to use the “Need login help” function on the Vanguard website.

Step by Step Guide with Vanguard

The following are the steps I used to open my first backdoor Roth IRA.

Step 1-Open an Account

The first step is to open your brokerage account with Vanguard, if you already have an account with Vanguard then you can skip this step.

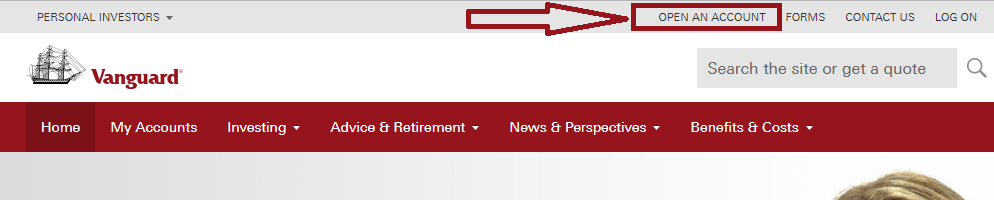

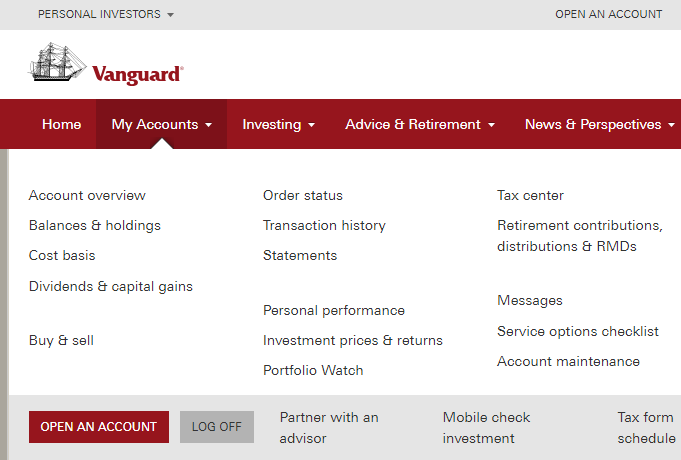

The first step is to go to the main Vanguard website and choose the personal investors option.

The next step is to click on open an account.

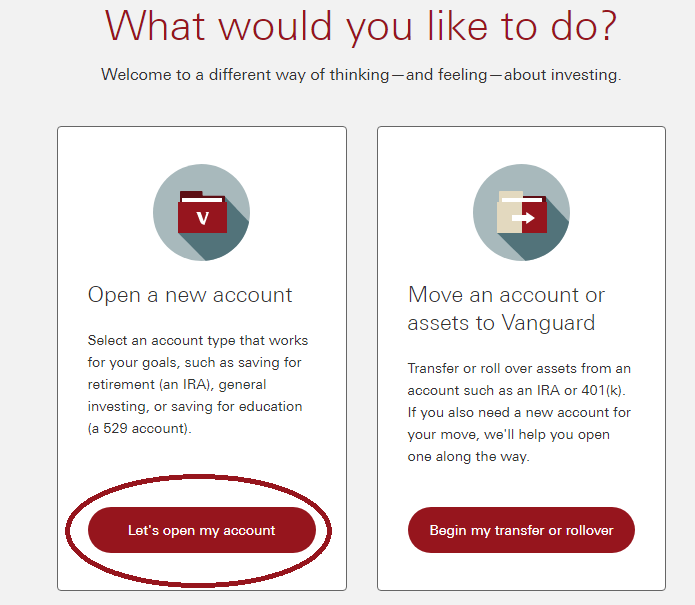

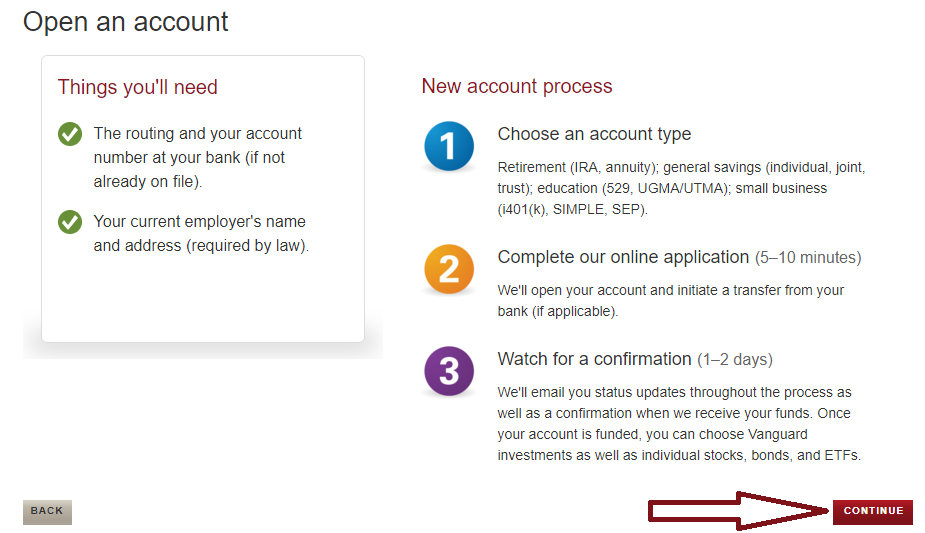

Follow the prompts and click on the “let’s open my account” button.

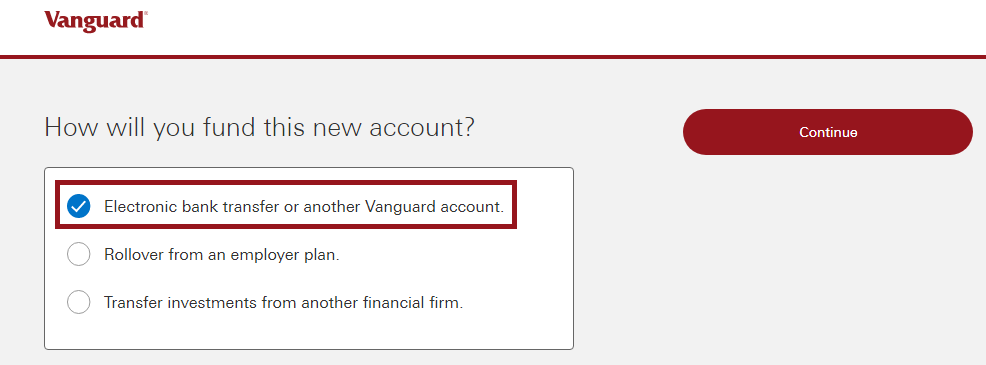

After this, you want to select an electronic bank transfer.

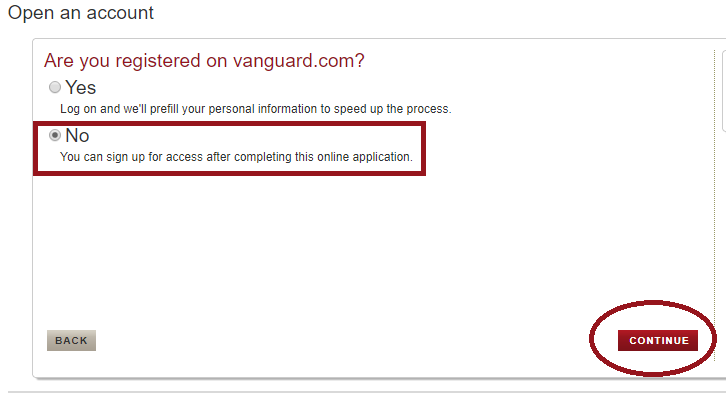

Click no if you’ve never had an account with Vanguard and enter your personal information required by Vanguard.

Next, click “Continue” to go to the next screen. This is where you’ll add your fund sources such as your primary checking account. This step can take from 1 to 2 days to complete.

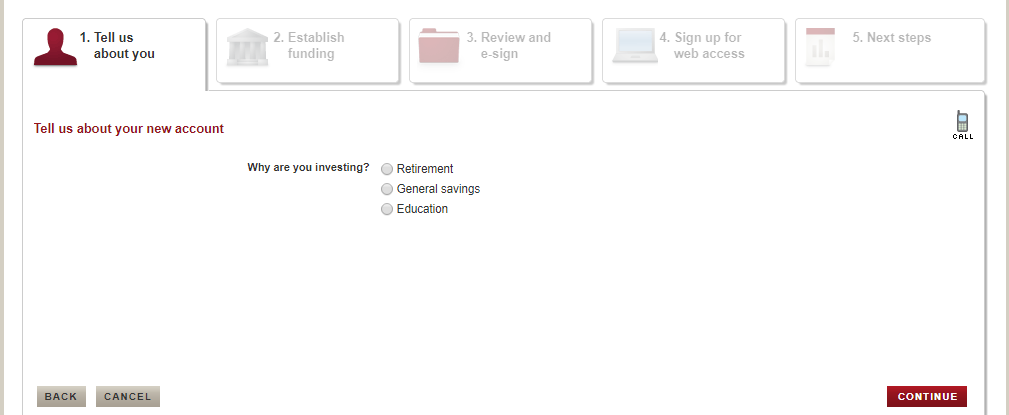

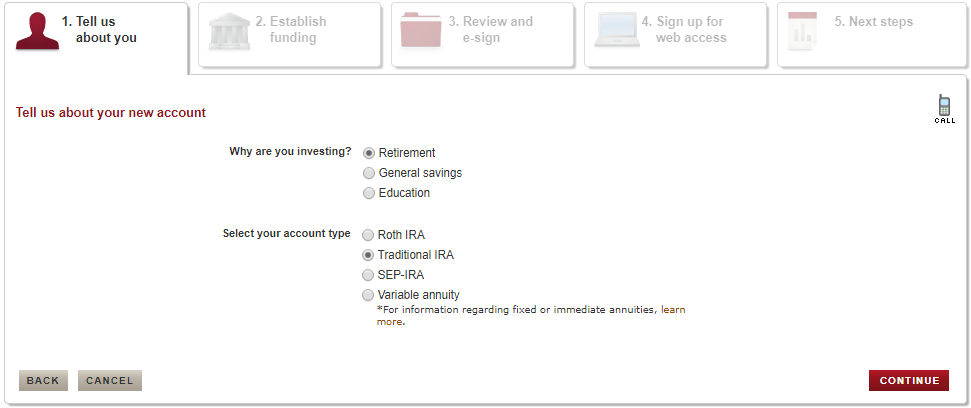

From here you have to choose the options of “retirement” and “traditional IRA.”

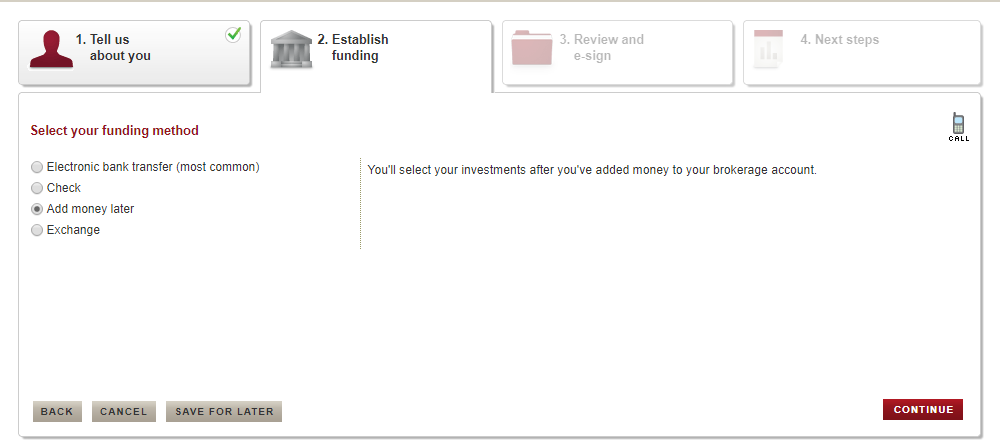

Step 1 of the application is to fill out your personal information. Make sure you select “add money later” so that you have control over when you wanted to transfer your funds as soon as you’re ready.

Once your traditional IRA is created, you’ll have to repeat all the steps over again to open a Roth IRA account.

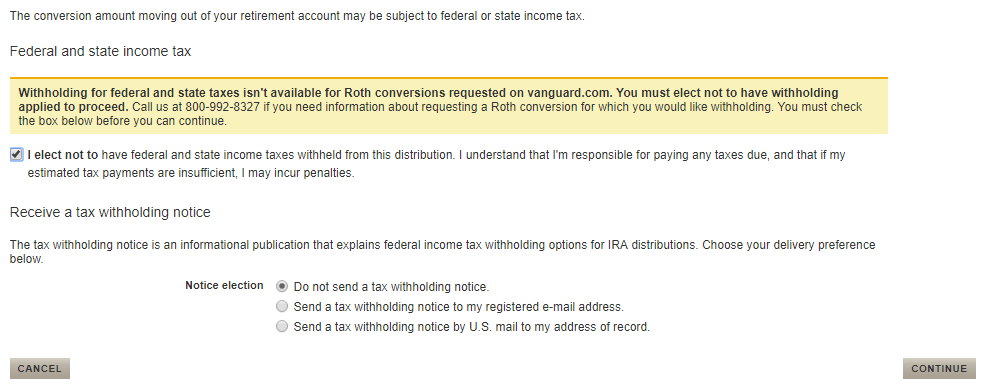

When it comes to federal and state tax withholding make sure you elect to not have federal and state income taxes withheld since you’re using after-tax money to perform the back door Roth IRA conversion.

You’ll take care of this later when you file for your taxes and complete tax form 8606.

Convert to Roth IRA aka Backdoor Roth IRA

After your two brokerage account is set up, you’re ready to fund the traditional IRA account.

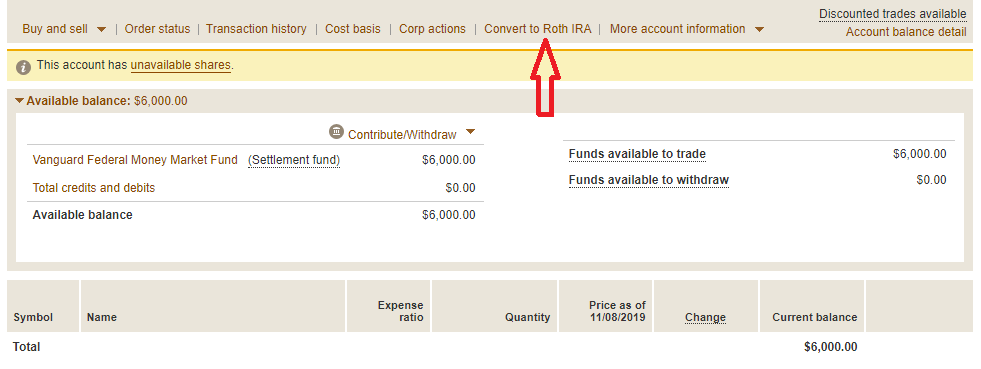

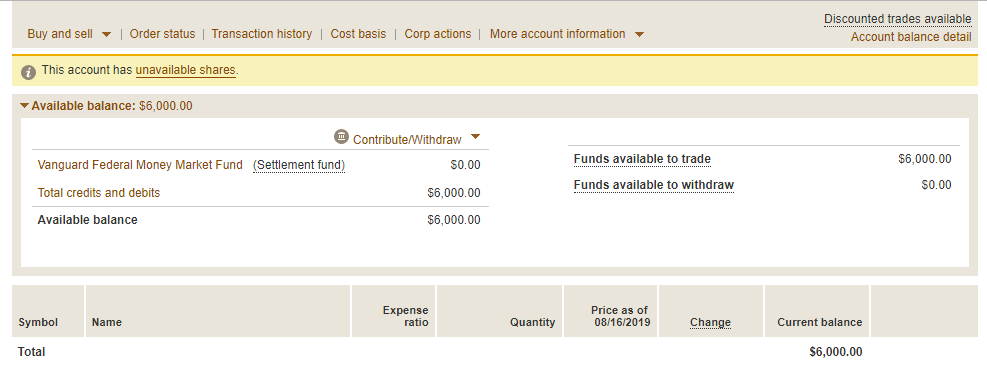

When you initiate the transfer of money from your bank, your funds will go to a settlement fund. In Vanguard’s case, it will take anywhere from 3 to 7 days for the funds to be available.

Vanguard will deposit your money into the Vanguard Federal Money Market Fund (VMFXX).

As soon as the money is available you’ll want to covert the money in your traditional IRA account to the Roth IRA account.

There are those who advise that you wait for a period of 4 weeks before you do a traditional IRA to a Roth IRA conversion. I don’t see the need for this and I converted it right away as soon as I can.

In summary, the act of funding your traditional IRA and then promptly converting it to a Roth IRA is dubbed a backdoor Roth IRA.

Once the money is available in your account then you’re free to purchase the funds of your choice.

I am planning on building my IRA into a three-fund portfolio.

Final Thoughts

For the year of 2019, I successfully completed two backdoor Roth IRA. One for my wife and one for myself.

The stock market has been doing great for the latter part of this year and I am faced with a dilemma.

I know that you’re not supposed to time the market, but with the fund of my choice standing at $79.50 per share at the time of this writing, I don’t feel like it is the best time to convert my money from the money market fund.

I bought VTSAX for my wife when the cost per share is $72.50. That’s reasonable.

For myself, ever since I performed the backdoor Roth IRA, my money is still sitting in Vanguard’s money market fund.

I am waiting until the price per share is reasonable before I will exchange my holdings from VMFXX to VTSAX.

At the same time, I am also saving to have enough to open a taxable account also with Vanguard. In the taxable account, I am planning on using a dollar-cost average to purchase VTSAX and therefore, I don’t have to “time the market.”

With a backdoor Roth IRA, I am purchasing a Vanguard fund in a lump sum, and I don’t feel like it’s justifiable when the market right now is doing exceedingly well.

Perhaps I will wait for the market to go to its next adjusting period before I will purchase the total market stock index.

Pingback: Tax Loopholes You Should Know - Pharmacist Money Blog

Pingback: Will Social Security be there for me when I retire? - Pharmacist Money Blog