Betterment Review: Invest and Savings

I opened an account with Betterment 7 years ago in 2012. In this blog post, I will document my experience with Betterment.

Betterment along with Wealthfront are the two best and most well-known of the so-called robo-advisers.

They are called robo-advisors because they decided to cut the human middle man out of the equation and instead relied on its own proprietary computer-aided algorithm.

If you qualify for a premium plan, you can talk to and have unlimited access to a CFP, more on this later.

The founders believe that their computerized algorithm and the utilization of the modern portfolio theory of diversification will create a better performing portfolio than a human fund manager.

How does Betterment work?

Betterment uses exchange-traded funds (ETF) to invest your money. ETFs are defined by Investopedia as “a basket of securities that trade on an exchange, just like a stock. ETFs can contain all types of investments including stocks, commodities, or bonds. ETFs offer low expense ratios and fewer broker commissions than buying stocks individually.”

According to the above chart, in 2018, $5.1 trillion is invested in exchange-traded funds worldwide. And it looks like the trend point to continued robust growth for ETFs.

How to get started with Betterment

You begin by setting up a goal or multiple goals. For example, I set-up a “build wealth” goal in 2012. You don’t have to have a minimum to create an account with Betterment. However, there are management fees you have to take into consideration.

Betterment Digital is the starter plan with no account minimum and charges a 0.25% management fee annually. is the starter plan with no account minimum and charges a 0.25% management fee annually.

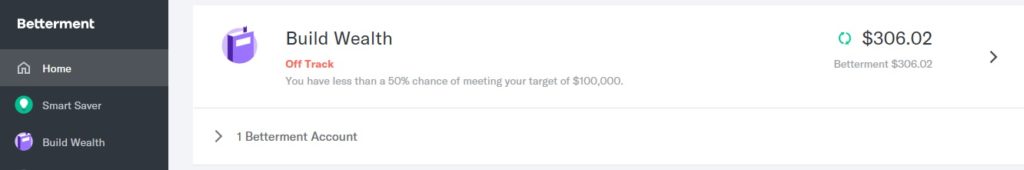

For example, I created a “build wealth” goal on Betterment and wanted to a target goal of $100,000 in 10 years. Betterment will monitor my investment and tell me if I am on target or off-target. At the current trajectory, I only have a 50% probability to reach my goal.

Betterment Premium provides unlimited phone access to a certified financial planner (CFP) for a 0.40% fee, this plan is only available with a $100,000 minimum balance.

Who is Betterment for?

Dependent on your goals, risk tolerance, and time frame, Betterment will perform a risk assessment for your goal and allocate your funds accordingly. For example, when I first started with Betterment, my allocation was 90% stocks vs. 10% bonds.

Betterment is best for hands-off investors and users with low balances like myself. Another feature that I like about Betterment is its automatic rebalancing feature.

Due to recent market volatility, Betterment adjusted my funds to a 67% stocks and 33% bonds.

As you can see from the screenshot above, Betterment’s standard portfolio uses ETFs from about 12 asset classes. I like Betterment for this fact, diversification is important to me. Just as importantly, Betterment is an extension of Vanguard, since a majority of the ETF funds Betterment utilizes are Vanguard funds.

The downfall of Betterment is the fact that you cannot directly buy index funds yourself.

Another unique aspect of Betterment is the option for the investor to choose a socially responsible portfolio. In essence, you get to pick ETFs from companies whose business practices align with your concerns-such as environmental issues.

Types of accounts supported

- Individual and joint nonretirement accounts

- Roth, traditional, SEP, and Rollover IRAs

- Trusts

- Ability to link external accounts for personalized advice

Let’s take a look at my own Betterment performance from 2012.

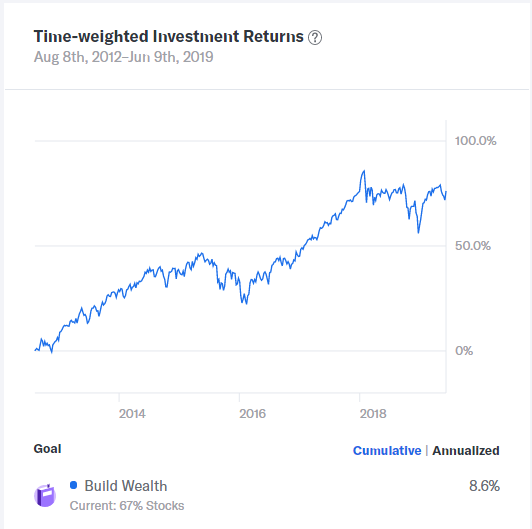

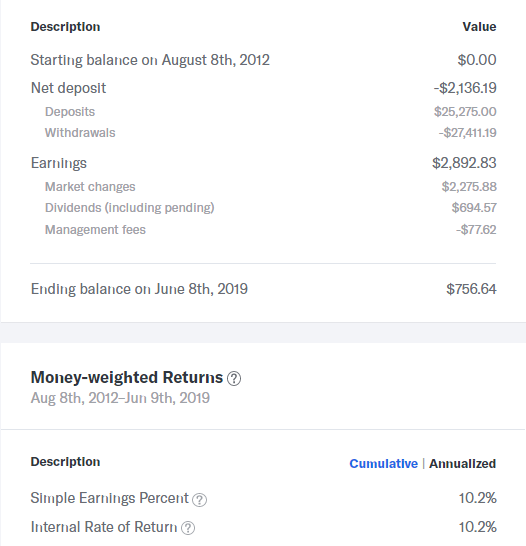

Since 2012, my annualized performance is 8.6% according to Betterment’s time-weighted investment returns.

Since 2012, I have deposited a total sum of $25,275. Through market appreciations and dividends, my account yielded an earning of $2,892.83. Of note, there was a $77.62 management fees assessed during this time frame.

I am planning to continue to fund my Betterment account, albeit modestly at $300 per month. I have been contributing to this same amount since 2012. Hopefully, when my finances are in better health, I’ll be able to invest more into my Betterment account in the future.

My annualized Simple Earnings and Internal Rate of Return is at 10.2%. To find out more about Betterment’s different return percentages, I turned to Betterment’s website for further explanation.

Explanation of different returns types from Betterment:

“We display three different return numbers, each with a distinctive purpose:

- Time-weighted return. As mentioned before, the time-weighted return is the total growth of a dollar invested at the beginning of the investment period. Time-weighted returns are unaffected by deposits or withdrawals, making a comparison to other investments more accurate.

- Simple earnings percent. This is simply the total amount earned over the investment period divided by the total amount invested. Deposits and withdrawals will impact this number, and significant withdrawals can make it hard to interpret.

- Internal rate of return. This is the total amount earned over the investment period divided by the average amount invested. Technically, this is called the modified-Dietz internal rate of return. Internal rate of return seeks to accurately account for the effects that the size and timing of deposits and withdrawals have on your account performance.”

It seems safe to assume an 8.6% annualized return is a more accurate return of investment for my account.

Tax Strategy?

Betterment uses tax-loss harvesting to offset taxes on both gains and income.

Smart Saver from Betterment

In May 2019, I turned on Betterment’s “Two-Way Sweep” and its Smart Saver feature. Smart Saver from Betterment offers a return of 2.18% after fees. The money in the Smart Saver account is invested in a low-risk bond portfolio.

However, Smart Saver accounts aren’t FDIC insured. The returns aren’t guaranteed and may fluctuate.

Two-Way Sweep

I linked my checking account to the Smart Saver account, and Betterment’s Two-Way Sweep will perform an analysis to move any unused cash it sees as excess based on my spending patterns into my Smart Saver account.

When my account runs low on funds, Betterment will move funds back to my checking account.

If you’d like to be more hands-on, you can choose for Betterment to send you an alert before a transfer is made, giving you the opportunity to cancel the transaction.

Betterment Everyday Savings

Smart Saver account will transition to the new savings account in August 2019. Here are some key features of the savings account.

- Up to 2.69% APY*, one of the highest I’ve seen

- FDIC insured, up to $1,000,000 (through partner banks)*

- Access to cash in 102 business days

- No limits on withdrawals

- No minimum balance

- No fees on your balance

*Partner banks: Barclays Bank Delaware, Citibank, N.A., Georgia Banking Company, Seaside National Bank & Trust, Valley National Bank.

*You have to be wait-listed to a future checking account in order to qualify for the higher rate, otherwise, the interest rate drops down to 2.43%

These perks are similar to the Sofi Money and other online savings bank.

Take Away and Summary

Betterment, in my opinion, is a good investment vehicle for a beginner investor who likes to “set it and forget it”. Goals oriented savings are beneficial for those who plan to save for a house, car, vacation or building wealth. Automatic rebalancing is helpful to minimize losses from market volatility.

The main reason that I got started with Betterment is to set aside money to pay off my student loans and also to test out its performance over time.

Overall, I am happy with my 7 years of experience with Betterment. I will continue to have an active account. However, as I accumulate and build up my portfolio I may have to move the majority of my funds to Vanguard and buy one of its total stock index funds.

Take Away Point

Betterment is a good tool to help a beginner investor get started with investing. Over time, it makes more sense to move into another investing platform such as Vanguard or Fidelity to take advantage of its low fees ratio and a more hands-on approach.

Pingback: Financial Engines Review - Pharmacist Money Blog

Pingback: I Will Teach You to be Rich Summary - Pharmacist Money Blog