How to Get Rich Slowly as a Pharmacist

Lately, I’ve been thinking a lot about how pharmacists can build wealth and I’ve come to the conclusion that getting rich slowly is the key.

You’ve heard it on the radio, you heard it on television, or perhaps read it in a blog just like this one-uncover this secret, buy this and that to get rich quickly! That is not what I am proposing. You have a lifetime to accumulate wealth, don’t fall for the get rich quick scheme.

Aside from the steps outlined below, it helps if you abide by these principles: pay yourself first, live below your means, watch your expenses and the rest will follow.

After all, steady wins the race.

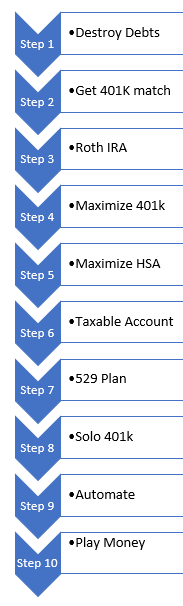

How to Get Rich Slowly

Step 1. Get Rid of Your Debts

The crux of my plan on how to get rich slowly is a step-wise approach. The first step to my plan is to get rid of your debts.

Average pharmacists graduated in 2020 with a student loan burden of around $170,000 according to AACP’s 2019 survey.

When broken down into public versus private institutions the average student loans amounted to $144,083 versus $198,560 respectively.

On top of that, if you’re like the average American, you’re like to have a credit card balance with a high interest rate.

Therefore, the first and foremost step is to get rid of your credit card and student loan debt using either the proven methods of a debt snowball or a debt avalanche outlined in my student loan guide.

As a general guide, it is best to pay down debts that have a higher interest rate. The rule of thumb to go by is anything that has a 5% interest rate or more should be taken care of first. Examples include credit card debts and student loan debts.

Any amounts of debts that have 5% or lower interest rates are up for debate. At this point, you can choose to pay down those debts slowly and invest the difference since market returns have averaged north of 5%.

Step 1B: Fund an emergency fund that will be at least 3 to 6 months of your living expenses.

Step 2. Contribute Enough to get 401k Match

Step 2 of the get rich slowly scheme is to contribute enough to get the employer 401k match.

If you’re a full-time employee, chances are high that you will have a 401k account administered by your employer.

Your employer will usually offer a matching contribution up to a fixed percentage, usually, this ranges from 3 to 6%.

If you’re still paying off debts or a new pharmacist starting out absolutely take advantage of this offer since it is essentially free money.

There are two types of 401k, traditional and Roth 401k. With traditional 401k, your contribution will be tax-deductible but your earnings will be taxed upon withdrawal.

Roth 401k is utilized when you contribute using after-tax money. The advantage to Roth accounts is that when you’re ready to make withdrawals, your money will be tax-free.

If you’re a young pharmacist, say 24 to 26 years old, then it makes more sense to take advantage of traditional 401k. If you’re older and at peak earning years then a Roth 401k may be a better option for you.

A 401k account is a great retirement investment vehicle, make sure you pay attention to the types of investments available and its expense ratios. Look for low expense ratios mutual funds in your plan’s offerings and build your portfolio from those options.

Step 2b. How to Build your Portfolio

When looking for low-cost investment options, you’ll likely end up with a list of index funds.

My favorite type of index fund is broad-based index funds such as one tracking the S&P 500 or better yet, a total stock market index fund.

If you chose an S&P 500 index fund then it may be advantageous to add a small to mid-cap index fund to capture the total stock market. Additionally, you may want to add an international index fund to complement the US-based index funds to capture the majority of the world’s stock market.

Lastly, you need to add a total bond index fund to decrease the volatility risk of the stock market. Index funds typically will give you a return of investment (ROI) ranges from 6 to 10% depending on the stock market’s average performance. Bonds index funds will typically give you an ROI of 3 to 5%.

This is one of my favorite portfolio setup called the three-fund portfolio where you will get to get invest your money into all of the world’s investable stock offerings. Lastly, you may want to come up with an asset allocation plan that is appropriate for your age and risk tolerance.

Step 3. Maximize Roth IRA Contribution

Step 3 of how to get rich slowly is to maximize your Roth IRA contribution for the year. As of this writing, the current Roth IRA contribution maximum is $6,000. If you got your financial house in order, and with your pharmacist’s salary, I believe that you can come with a lump sum of $6,000.

Wait, isn’t it true that because of a pharmacist’s average salary of $136,591 according to Salary.com that pharmacists are ineligible to contribute to a Roth IRA account? In fact, you can contribute to a Roth IRA account using what’s known as a backdoor Roth IRA.

Essentially. you’re contributing after-tax money to a nondeductible traditional IRA and immediately convert the contribution into a Roth IRA account.

However, you need to be careful with this since if you have money already in your traditional IRA account you may be subjected to the pro-rata rule and this can get messy.

The pro-rata rule specifies that you cannot mix pre-tax money with after-tax money. If you did so, then both of the money will be combined and you’ll not be able to separate out the two different amounts for tax purposes.

Step 4. Maximize 401k Contribution

Hopefully, you’re smooth sailing through your previous steps and arrived at this step of our get rich slowly plan. In step 4, you’ll now will up your game and increase your contribution to the maximum allowable by the plan. As of 2020, the maximum allowable contribution to a 401k plan is $19,500.

The best strategy is to spread our contributions over time so that you don’t have to contribute a large portion all at once. If you did this, you’ll be able to enjoy the benefits of dollar-cost averaging and possibly avoid complications with the employer match.

For example, if you plan to front-load your 401k contribution in the early part of this year, you may be finished with your contribution by mid-year or sooner. Since you are no longer contributing to your plan for the remainder of the year then that will forfeit the employer match.

However, fortunately, 401k plans will usually have a rule put in place to protect you from this and will give you your match at the end of the year.

For those reasons above, I do not recommend front-loading a 401k even if you have to financial wiggle room to do so.

In some cases, the maximum contribution limit of $19,500 is not entirely correct. Some 401k plans may allow after-tax contribution up the limit of $56,000. When this is allowed by your plan, you can engage in a strategy known as a mega backdoor Roth IRA.

This strategy is beyond the scope of this post so I will not discuss it any further. Perhaps in another post in the near future.

Step 5. Maximize Health Savings Account (HSA)

In order to qualify for an HSA, you have to be enrolled in a high deductible health insurance plan. HSAs are a great tax-sheltered plan in itself. You can use the money in your account to pay for qualified medical expenses.

However, you can choose to defer dipping into this fund and use it as an additional retirement fund. You can choose to save up to the required cash amount of $2,000 and invest the amount in excess in index funds such as the Vanguard Total Stock Index Fund (VTSAX).

In this strategy, you’ll pay out of pocket for your healthcare expenses while saving your receipts. During retirement, you can reimburse yourself for healthcare expenditures of the past. HSA, in my opinion, is one of the best tax-advantage plans since it provides you with a triple tax benefit:

- Contributions are tax-deductible

- Earnings grow tax-free

- Withdrawals are tax-free if used for qualified medical expenses

For 2020, the annual limit for a HSA plan for an individual is $3,550 and $7,100 for families according to the IRS.

Step 6. Contribute to a Taxable Account

After you’ve maximized all of your tax-advantaged plans then the next logical step is to open a taxable account. I chose to open my taxable account with Vanguard since they offer an array of low-cost index funds that are also tax-efficient.

Later in life, you will have to be aware of the current capital gains tax bracket and strategize where to pull money from and its tax impacts.

One of the best buy and hold index funds out there offered by Vanguard is its total stock market index funds (VTSAX).

You can choose to invest as much money as you like in this account. I chose to match my Roth IRA amount of $6,000 per year for now and increase it as I am able to in the future.

Step 7. Open a 529 Plan

If you have children, a 529 plan is a great tool to use for college savings. 529 plans offer some advantages but the best advantage is that earnings are tax-free as long as the money in the account is earmarked only for education expenses.

Another benefit is that 529 plans have a high contribution limit. Texas, the state of my residence has a maximum contribution limit of $370,000.

You don’t have to reside in the state in order to open that state’s 529 plan. I recently opened a 529 plan with Vanguard and the state of Nevada turns out it has the same contribution limit as with the state of Texas.

Lastly, tax deduction is an additional benefit in certain states, be sure to find out for your state’s 529 plan offer tax benefits.

One last tidbit, a 529 plan can be used to pay for K-12 education expenses if you elect to do so.

Step 8. Individual 401k Plan

If you’re a small business owner, you are entitled to open retirement plans such as a simplified employee pension plan individual retirement account (SEP-IRA), an individual 401k or solo 401k plan, and A Savings Incentive Match Plan for Employees Individual Retirement Account (Simple IRA).

Each plan has its advantages and disadvantages but for individuals with side hustles such as a blog, YouTube, Podcast, and gig economy jobs a SEP-IRA or Solo 401K is the best option.

I chose to open a solo 401 K with Vanguard and I will write about this topic in another post.

Step 9. Automate Your Finances

Once you have all of your tax-advantaged accounts opened, the next step to the last step to getting rich slowly is to automate your finances.

Take the time to log in to all of your accounts to check if they have automatic contributions features. For example, you don’t have to automate your 401k contributions since this is already done for you every paycheck.

You can automatic your contribution to a Roth IRA account monthly but for pharmacists and other high-income earners, unfortunately, you have to perform a manual contribution yearly via the backdoor Roth IRA loophole.

For your emergency fund, you can set up an automatic transfer each month to a high-yield savings account of your choice. It’s always a good idea to have your emergency funds stored in an FDIC insured high-yield savings accounts since traditional banks have a dismal interest rate.

You won’t even need to check your investments that often. In fact, once a year you can log into your accounts and perform a yearly asset re-balancing to make sure that your portfolio’s asset allocation is on par with your long-term plan.

You can also take the time to automate other aspects of your financial life such as paying for credit cards and other bills. Paying off your credit cards on time and keeping credit utilization low can be a good credit score booster.

Step 10. The 10% Rule

Investing and saving can monotonous and boring.

So you want to test your investment skills and time the market? Go ahead, pick stocks buy the exotic stock, or hot trending stock everyone’s talking about. Do you want to send some money into private real estate crowdfunding? You certainly can do so? What about gold and silver? Go on right ahead.

Just remember that this money is something that you can afford to lose it all.

How to Get Rich Slowly Conclusion

Thus far, I’ve discussed how you can get rich slowly using the steps I mentioned above. Once you have all the wheels in motion, investing in these accounts can be rather dry, boring. and will take years for you to reap the benefits.

The founder of Vanguard, Jack Bogle’s best investment advice is to block out the noise and stay the course! I believe he also emphasized the fact that it is advantageous for you to time the market but your time “in” the market.

However, this is absolutely the right away to approach retirement savings and investment. Investments should be boring, simple, and not exciting.

However, if you do have the itch to mix things up and create excitement in your investment and finances you can set aside the maximum of 10% of your assets and designate that money as play money.

This is exactly what I am planning on executing to earn a net-worth north of one million dollars and become the next pharmacist million.

How rich will I be in 30 years?

The Power of Compound Interest

If you want proof of concept, let’s talk a look at the math. For simplicity, let’s say you were able to follow the 10 steps approach outlined in this article at age 30. Your time horizon until retirement is 30 years.

- 401k=$19,500

- Roth IRA=$6,000

- HSA=$3,550

- Taxable=$6,000

Just accounting for these major accounts, the grand total is $35,050 x 30 years = $1,051,500. You’re a millionaire at 65 years old. But wait, we have not accounted for the magic of compounded interest.

Using this compounding calculator and an average return of 6% will yield a total of $2,770,198.84. If we’re optimistic and our average return is 8% then the total amount jumped to $3,969,443.72!

Fellow pharmacists, if you follow the steps outlined in this post, all you have to do now is sit back and relax. Watch your money grow, and enjoy your slowly getting rich life!