The Richest Man in Babylon Summary

Continuing with my book review series, in this post I will summarize and showcase the top 5 lessons from The Richest Man in Babylon by George S. Clason.

It’s true that money principles derived thousands of years ago can still be relevant and applicable today. Let’s dive into the top 5 takeaways from this book.

Richest Man in Babylon Lesson 1: Pay yourself first

The richest man in Babylon found the road to wealth when he came across these truths:

A part of all I earned was mine to keep-and so will you.

Richest Man in Babylon

The following paragraph is an excerpt from the book.

But all I earn is mine to keep, is it not? Far from it, do you not pay the garment maker? Do you not pay the sandal maker? Do you not pay for the things that you eat?

What have you to show for your earnings of the past month? What for the past year? Fool! You pay to everyone but yourself?

Might as well be a slave and work for what your master gives you to eat and wear!

This is a powerful analogy to see every expense you have as you slave away for someone else. If your net income is $4,000 per month and paid $2,000 in rent. You’re effectively working 20 hours a week for your landlord.

And this is something Rich Dad, Poor Dad discussed ad nauseam.

In the book, it is suggested that once you get your salary, before any other expenditures-pay yourself one-tenth of that amount.

This way you make sure that you always earn money for yourself before slaving for others.

How to pay yourself first?

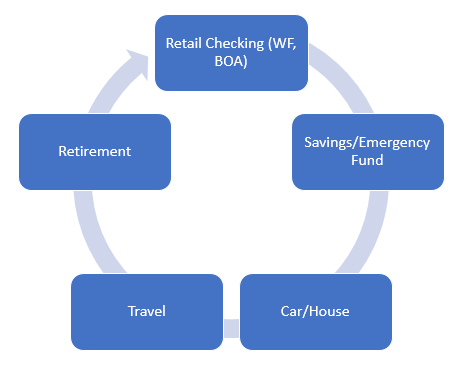

Picture yourself working a 9 to 5 job and you’re getting paid every two weeks. Assuming you’re using a retail bank like Wells Fargo, all of your money will be deposited here.

The key to paying yourself first in the 21st century is to automate your savings. Your first step is to open an online savings account such as Sofi Money or Betterment Everyday Savings account. These high-yield savings account will give at least 2% interest, which is more than 20x what your retail bank will offer.

I recommend you to automatically take out of a portion of your paycheck and break it down to different buckets such as:

- Retirement fund ($500 per month to get to IRA max of $6,000)

- Car fund ($400 per month), save enough to pay the car new/used with cash

- Travel fund ($200 per month), use online savings account for this fund

- Savings/emergency fund ($200 per month), remember the rule of thumb is 3 to 12 months of expenses

- Primary residence/investment house fund ($1000 a month), save up to 20% for a down payment

*These numbers are provided just as a visual representation of the concept, your personal financial situation may require adjustments tailored to your needs.

This way, you won’t see the money that is being automatically deducted from your paycheck. You will only spend what you have in your primary account. What you don’t see is what you will not spend. There is a psychological component to this and this will force you to be creative and live within your budget.

I will explore the 50/30/20 budget rule and the envelope system in another post. So stay tuned!

Richest Man in Babylon lesson 2: Men of action are favored by the goddess of luck

Most people when seeing successful persons such as Michael Jordan, Warren Buffet, Jeff Bezos and Donald Trump attribute it all to luck.

They come up with all kinds of excuses for why they are not in the same position as these aforementioned people, such as-well they have talents, they met the right people at the right time. Or they were born into it (Trump).

While this may be the case for some successful people, it’s certainly not for the large majority of them.

The common denominator among all of them is that they have been taking action.

Think of this: a procrastinator and a doer are faced with opportunities. For the sake of simplicity, the chance of succeeding when taking in the opportunity is equal.

What separates them though is the number of opportunities that they acted upon.

The procrastinator will always come up with excuses. “I don’t feel good today. I had a rough day at work..”

Meanwhile, the doer tries it out and takes all the opportunities given to him. Therefore, the chance that the doer succeeds at some point is way higher than that of the procrastinator.

It has nothing to do with luck, and everything to do with action, more importantly, taking the right action when a good deal comes their way.

Richest Man in Babylon lesson 3: Wealth is not a matter of income

Take this analogy: The richest man in Babylon address a class eager to learn how to replicate his success.

Yesterday, how many of you carried lean purses? “All of us,” answers the class.

Yet though you do not all earn the same. Some earn much more than others. Some have much larger families to support. Yet, all purses were equally lean?

Now I will tell thee an unusual truth about men, and sons of men. It is this: What it is each you call “necessary expenses” will always grow to equal our income unless we protest to the contrary.

I know a lot of smart people that earn good money. Yet they have nothing to show for in their bank accounts.

Every time they get an increase in salary, they increase their spending with the same amount.

Examples including new furniture, new subscription services, or other luxury items. In other words, keeping up with the Joneses. In the end, all the materialism will cause you to be handcuffed to your current job, living paycheck to paycheck.

If you don’t get that paycheck, what is going to happen to your boat, your house, and your car?

This is also one of the reasons the Millionaire Next Door cited as a deterrence to be wealthy.

Everyone must abide by the law of income minus expenditures equals savings.

No matter if you’re a pharmacist, engineer, pharmacy technician, or a McDonald’s crew member.

Richest Man in Babylon lesson 4: Act when the time is right

If you find a good deal, let’s say on a real estate investment, and you ran the numbers and every other analysis, don’t be afraid to act on it. Great opportunities are rare and should never be missed out on.

I believe the term coined for this indecisiveness is paralysis by analysis.

Another example, during the financial crisis and the following collapse of the stock market in 2008 and 2009. If you had saved up a good chunk of money to invest, you’d be handsomely rewarded with a nice return of your investment.

Since you were able to buy low and benefited from the gains in the subsequent years.

Richest Man in Babylon lesson 5: The power of passive income

Once you start to obey and swear by rule number one-pay yourself first-you will accumulate a lot of money over time.

While this is a great accomplishment, as soon as possible, you should start to put your hard-earned money to work.

Money never rests, your money will work for you while you go to class, while you’re at work, and yes even while you’re sleeping. This is what people like to refer to as passive income.

An excerpt from the book: If you decide to keep your slaves, they will breed. Even the kids will breed eventually. This will cause your money to grow exponentially. *Remember that slavery was legal in ancient Babylon.

This is another example of the power of compound interest. Money over time will grow exponentially.

Final Thoughts

Let’s recap the most important lessons from the book.

Lesson 1: Pay yourself first

Lesson 2: Men of action are more likely to be lucky in the long run

Lesson 3: Wealth is a function where expenses are the most important factor, not income

Lesson 4: Take action when the time is right

Lesson 5: The power of passive income and exponential income.

You can use this calculator to calculate compound interest or you use the rule of 72 to estimate when your interest will double in value.

According to Investopedia, the rule of 72 is when you take 72 divides by the annual rate of return to get the number of years your initial investment will double itself.

This post may contain affiliate links, please read our affiliate policy for more details.

Want to hear the full book on Audible? Get 2 free books using this link. You can also buy the paper version here if you’re a fan of good old fashion paperback.

I really did enjoy the book and I am sure you will too!

Pingback: 7 Finance Books that Changed My Life - Pharmacist Money Blog