Three fund portfolio: asset allocation

This post may contain affiliate links, please read our affiliate policy for more details.

If you have been keeping track of the stock market’s volatility lately, like most investors, you’ll probably want to take a peek your portfolio, asset allocation, and performance.

Particularly, if you’re a fan of the three-fund portfolio, you’d wanted to know how it’s performing and make sure that you have the ideal asset allocation.

I recently finished listening to The Bogleheads’ Guide to the three-fund portfolio. After that I dived right into another book by Taylor Larimore et. al. called, “The Bogleheads’ Guide to Investing.”

The latter book covers from A to Z about investing, especially for those who are a do it yourself (DIY) investor.

These two books became one of my favorites in investing.

From the influences of these two fantastic books today I want to focus on two topics: three-fund portfolio and asset allocation.

Three Fund Portfolio

I discussed Taylor Larimore’s Three Fund Portfolio strategy in another post but I didn’t focus too much on one of the most important aspects of investing: asset allocation.

Therefore, I wanted to focus on asset allocation in this post.

You can explore the three-fund portfolio by browsing through this forum thread or the wiki both from Bogleheads.

The main advantages of using the three-fund portfolio are:

- Huge diversification with over 15,000 worldwide securities (low-risk investment)

- Low expense ratios

- Tax-efficiency

- Simplicity

Most DIY investors choose Vanguard as the go-to investment platform.

You can build the three-fund portfolio by setting up these three Vanguard index funds.

- Vanguard Total Stock Market Index Fund (VTSAX)

- Vanguard Total International Stock Index Fund (VTIAX)

- Vanguard Total Bond Market Fund (VBTLX)

Vanguard is not the only option available. Alternatives include Fidelity and Charles Schwab and you can set up your portfolio this way.

Charles Schwab Three-fund portfolio

- Schwab Total Stock Market Index (SWTSX)

- Schwab International Index (SWISX)

- Schwab U.S. Aggregate Bond Index Fund (SWAGX)

Fidelity Three-fund portfolio

- Fidelity Total Market Index Fund (FSKAX)

- Fidelity Total International Index Fund (FTIHX)

- Fidelity U. S. Bond Index Fund (FXNAX)

Three-fund Portfolio ETF versions

Alternatively, you can build the three-fund portfolio using ETFs.

From Vanguard

- Vanguard Total Stock ETF (VTI)

- Vanguard Total International Stock ETF (VXUS)

- Vanguard Total Bond Market ETF (BND)

From Charles Schwab

- US Broad Market ETF (SCHB)

- International Equity Index ETF (SCHF)

- U. S. Aggregate Bond Index ETF (SCHZ)

From iShares

- iShares Core S&P Total Market ETF (ITOT)

- iShares Core MSCI Total International Stock ETF (IXUS)

- iShares Core Total U.S. Bond Market ETF (AGG)

Asset allocation

Asset allocation is very important and has a huge impact on an investor’s risks as well as returns.

Asset allocation is deciding how much percent of your total portfolio will be in stocks and how much will be in bonds.

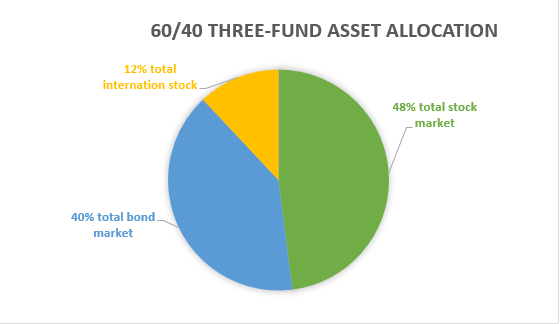

The three most common asset allocation is 60/40, 80/20 or the “lazy portfolio” 34/33/33 splits.

Three Fund Portfolio 60/40 asset allocation

- 48% in total stock market

- 40% in the total bond market

- 12% in total international stock market

Three Fund Portfolio 80/20 asset allocation

- 64% total stock market

- 20% total bond market

- 16% total international stock market

Three Fund Portfolio equal parts

- 34% total stock market

- 33% total bond market

- 33 total international stock market

There is really no right or wrong asset allocation, you design your allocations based on a combination of factors such as your age, risk tolerance, expected returns and time horizon.

Asset Allocation Bogleheads’ Guide

Outside of the three-fund portfolio, Taylor Larimore, Mel Lindauer, and Michael LeBoeuf recommended the following asset allocations in their book.

Young investor allocation (in your 20s)

- Domestic large caps stocks 55%

- Mid-caps stocks 25%

- Intermediate Bonds 20%

Using Vanguard funds

- Total stock index fund 80%

- Total bond index fund 20%

Middle-aged investor

- Domestic large-cap stocks 30%

- Domestic small/mid-cap 15%

- International funds 10%

- REIT 5%

- intermediate bond 20%

- Inflation protected securities (TIPS) 20%

Using Vanguard

- Total stock index fund 45%

- Total international index fund 10%

- REIT 5%

- Intermediate bond 20%

- TIPS 20%

Early retirement investor

- Diversified domestic stocks 30%

- Diversified international stocks 10%

- Intermediate bonds 20%

- TIPS 30%

Using Vanguard

- Total stock market 30%

- Total international stock 10%

- Intermediate bond 30%

- TIPS 30%

Late retirement investor

- Diversified stocks 30

- Bonds 40

- TIPS 40

Using Vanguard

- total stock market index fund 20%

- total bond market index fund 40%

- TIPS 40%

Asset allocation rule of thumb

These are just a general rule of thumb and once again, there is no such thing as the perfect asset allocations. It all depends on each individual investor’s preferences.

Your age in bonds

One of the most well-known rules of thumb is the “your age in bonds” rule. For example, if you’re 30 years old then your bond allocation is 30%.

In contrast, if you’re 60 years old, then your bond allocation is 60%. This rule is suggested by John Bogle, the founder of Vanguard and discussed by Taylor Larimore in his book “The Bogleheads’ Guide to Investing.”

100 minus your age

This is a straight forward rule, take 100 and subtract it from your age. For example, I am 36 years old, 100-36=64. That means I should allocate 64% to stocks and the rest to bonds.

Some financial gurus think that the 100 minus your age rule is too conservative. Therefore, some are advocating for the use of 110 minus your age or even 120 minus your age rule of thumb.

So for my case, using the 110 minus my age, my stock holdings should be 74%.

Using the 120 minuses my age rule instead gives me an 84% stock allocation.

Using an online asset allocator calculator.

There are a plethora of online asset calculators. You can use the asset allocation calculator from CNN Money.

Alternatively, you can use an alternative asset allocator calculator from Smart Asset here.

Asset allocation help

Fortunately for us, in the age of Robo-advisors and apps, there is help.

I will discuss the two that I am most familiar with: Financial engines and personal capital.

Financial engines

I discussed the financial engine’s fee structure in this post,

Fortunately, I found out that financial engine advising is free for me to use since my employer negotiated this on my behalf.

I will not be charged with a fee if I do my own rebalances.

In a nutshell, Financial Engines charges clients from 0.2% to 0.6% of their 401(k) assets annually to manage their retirement funds based on the modern portfolio theory (MPT), developed in the 1950s by Nobel Prize-winning economist Harry Markowitz.

MPT attempts to maximize the return for a given level of risk. Its computers run thousands of scenarios (known as a Monte Carlo simulation) to give each worker a picture of how much retirement income he or she is likely to receive.

These simulations help determine the best portfolio given the costs, quality, and styles of the mutual funds available in each 401(k), with a preference for low-cost index funds.

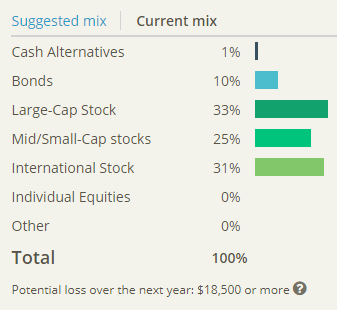

Below is an example of what financial engine Robo-advising looks like.

My current asset allocation.

Here what a suggested asset allocation from financial engines looks like.

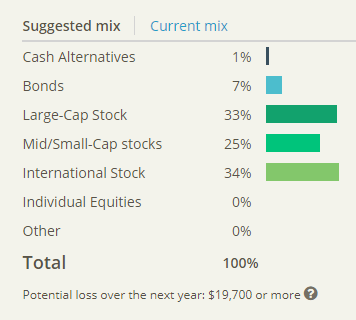

Personal capital

Personal capital also relies on modern portfolio theory.

In a way, personal capital is very similar to financial engines. You can use personal capital to guide your asset allocation the same way as FE.

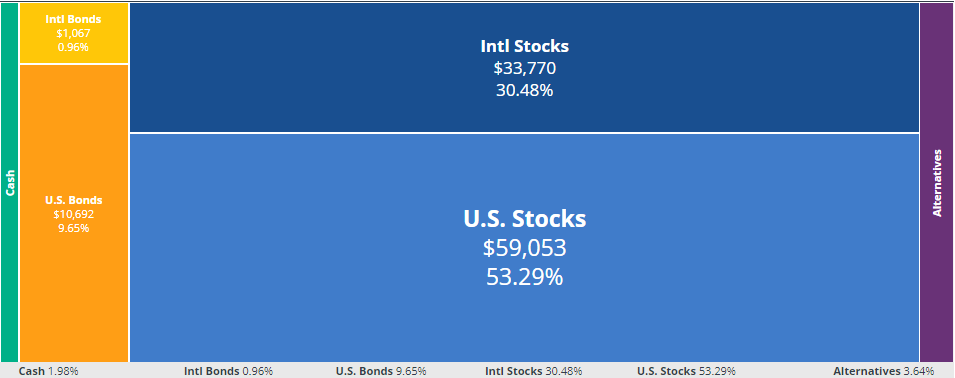

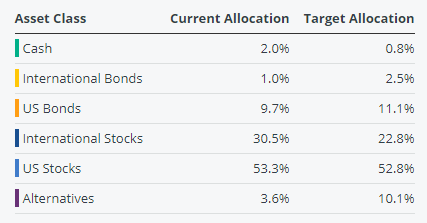

My current allocation according to the Personal Capital Dashboard.

Personal capital’s suggested asset allocation.

Additionally, PC can tell you which asset class you’re underweight in and which ones you’re overweight in.

Overall, both financial engines and personal capital favors a more complex portfolio featuring, large caps, mid-caps, small-caps, and alternatives.

Personal capital defined alternatives such as real estate investment trust (REITs) and commodities such as gold or oil.

Rebalancing

This section is probably the most important topic for me. I just recently switched from a managed account to a DIY for my 401 (k) account.

This is true, especially with the recent market volatility. I am concerned about setting up the best asset allocation for myself.

Since switching to a DIY approach, I have rebalanced my funds twice in a span of two months. Larimore, in his book, mentioned a few common-sense approaches when it comes to rebalancing.

Keep in mind that you’re rebalancing to keep your asset allocations in line with your plan and not a response to market volatility. It’s important to keep emotions out of this.

Another important recommendation from Larimore is selling high and buy low.

Therefore, using a date like a birthday, holiday or any other easy to remember dates will make the process less dependent on your emotions.

They can be:

- Annually

- Semi-annually

- Every three months

- Monthly

- Positive or negative 5% deviations (a.k.a expansion bands)

*The most common frequency for rebalancing is annually, semi-annually, and quarterly. I am sticking with quarterly, then semi-annually and work myself up to annually.

Specifically, Taylor Larimore mentioned in his book that a Morningstar study found that rebalancing every 18 months is as equally effective as the other frequencies.

Another added benefit is that in a taxable account, capital gains tax is lower for assets that are held longer. So another benefit of rebalancing less frequently is low taxes.

How to rebalance?

You can also take out the money from a fund by selling high, especially if you are in need of money.

Another method is to direct more money into a fund that is below your targeted asset allocation, preferably buying low when you do so.

Rebalance your tax-deferred plan first and if you’re in a withdrawal period, such as the minimum required distribution, use that amount as a rebalancing tool.

Tax-loss harvesting

The best way to rebalance is to sell outperforming asset classes and buy more of the underperforming ones. This is known as tax-loss harvesting.

In your taxable accounts, sell your losing assets before December 31st in order to offset capital gains from winners.

How often should I check my portfolio?

Checking frequently can serve as an educational tool-show how your assets react to market conditions.

Checking frequently is reserved for those that are confident in their asset allocation strategy and firmly believe in holding their investments long-term.

For those that are unsure of their asset allocation (like me) and are impulsive, it is best to only check your portfolio only once a year.

Three-fund portfolio returns of investment

Portfolio charts have an extensive array of charts and graphs for you to peruse.

With a time horizon of 10 years, three-fund portfolio returns look like this.

- Average-5.8%

- Stretch (85th percentile)-8.7%

- Maximum returns-11.2%

Tax efficiency

When building a three-fund portfolio it is important to look at tax consequences. Taylor Larimore recommended shielding the most tax-inefficient funds in tax-sheltered funds such as 401 (k) or Roth IRA accounts.

Efficient

- Low-yield money market, cash, short-term bond funds

- Tax-managed stock funds

- Large-cap and total-market stock index funds

- Balanced index funds

- Small-cap or mid-cap index funds

- Value index funds

Moderately inefficient

- Moderate-yield money market, bond funds

- Total-market bond funds

- Active stock funds

Very inefficient

- Real estate or REIT funds

- High-turnover active funds

- High-yield corporate bonds

Using these guidelines from the Bogleheads wiki page, it is best to keep inefficient funds like bonds in a tax-advantaged plan like Roth IRA.

Funds from the total market index and international index funds should be kept in a taxable account because of its high tax efficiency.

Fear of Missing Out (FOMO)

Since fear of missing out is a real thing with Millenials, what is there outside of the three-fund portfolio?

The Wall Street Physician did a stepwise approach on his post here.

In summary, he suggested that you set up a portfolio consisting of one fund and add more funds all the way up to a total of five funds.

| Portfolio | Admiral Shares | ETF |

| One-Fund: Start with U.S. Stocks (S&P 500) | VFIAX | VOO |

| One-Fund: Start with U.S. Stocks (Total Stock Market) | VTSAX | VTI |

| Two-Fund: Add U.S. Bonds | VBTLX | BND |

| Three-Fund: Add International Stocks | VTIAX | VXUS |

| Four-Fund: Add International Bonds | VTABX | BNDX |

| Five-Fund: Add REITs | VGSLX | VNQ |

Final thoughts on asset allocation

This is a very good exercise to lay out some of the basics and recommendations for ideal asset allocation for me.

Suffice to say, there is no ideal asset allocation. Everything is dependent on two things:

- Your time horizon

- Risk tolerance

You have to come up with an asset allocation that you’re comfortable with and stay the course.

Only rebalance when it’s necessary and leave your emotions out of this crucial step.

I got to the realization that setting up a three-fund portfolio using my employer-sponsored 401 (k) is impossible.

In most 401 (k) plans you have two options, choose a target-date fund or come up with your own mix of funds from the list of options from your plan.

With this option, you can have it professionally managed or do it yourself.

Pick the option that you’re most comfortable with and be mindful of fees.

The two best accounts to set up a three-fund portfolio or a portfolio of your choice is through a traditional IRA, Roth IRA, or a taxable account.

I hope you get something from this lengthy post and if you enjoyed some of the ideas from Taylor Larimore, consider purchasing his two books:

Pingback: HSA with Optum Bank - Pharmacist Money Blog

Pingback: Should I open a 529 plan? - Pharmacist Money Blog

Pingback: 7 Finance Books that Changed My Life - Pharmacist Money Blog