What is the routing number of Wells Fargo?

I have to confess, I have to Google the routing number to Wells Fargo every time I needed it. I have been with Wells Fargo since 2002 so that’s a lot of Googling! That is why I am creating this post for my own reference and you’re welcome to use it as well.

History of Wells Fargo

Wells Fargo is one of the “big four” banks in the United States. The biggest four banks according to market capitalization are:

- JPMorgan & Co

- Bank of America

- Wells Fargo

- Citibank (Citigroup Inc.)

Wells Fargo was founded in 1852 by Henry Wells and William Fargo. In the beginning, they used six-horse stagecoaches to deliver important business information to their customers. Wells Fargo owns a large fleet of stagecoaches and still owns a fleet of 17 stagecoaches being used today for parades and events across the nation.

Thus the logo of Wells Fargo prominently features the six-horse stagecoach.

As mentioned above, I have been a long-time customer of Wells Fargo and still plan on using them because of familiarity. I am sure there are better banking options out there. I currently have savings accounts with Sofi Money and Betterment, the latter will launch a checking account in the near future.

Pros and Cons of Wells Fargo

Pros

- Wells Fargo has a large ATM network with over 13,000 ATMs nationwide.

- Give customers a chance to redeem themselves after an unforeseen financial setback

- A robust online bill pay program to pay bills

- Send/receive payments with Zelle via an email address or phone number

- Account alerts for deposits, payment or other custom alerts

- Zero liability protection on your debit card

- Deposit check with a smartphone

- Send text alert commands to 93557 with words like “BAL” for balance, “ACT” for a recent transaction or “DUE” for due dates

- Compatible with Samsung Pay, Apple Pay, and Google Pay

- 24/7 fraud monitoring

- Overdraft protection via Wells Fargo credit cards

Cons

- Charges fee for using non-Wells Fargo ATM

- Minimal interest (i.e. 0.01% APY)

- Hard to meet requirements to waive monthly service fees (such as direct deposit and savings account transfers)

- Pay a fee for overdraft protect

What is a routing number?

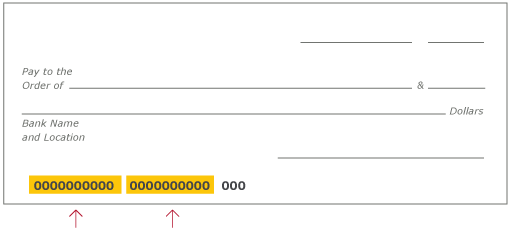

The routing number is usually located at the bottom of a personal check. It identifies the financial institution in a unique way. The routing number was created by the American Bankers Association (ABA) to make check processing secure and easier to manage.

Wells Fargo uses a 9 digits code that is required for wire transfer services. Also known as an ABA number, routing transit number (RTNs) or SWIFT code. It is used to maintain an account and to transfer money from one account to another.

The Federal Reserve Banks need routing numbers to process Fedwire funds transfers. The ACH network needs them to process electronic funds transfers i.e. direct deposits and bill payments.

The first four Wells Fargo routing numbers’ digits represent the Federal Reserve routing symbol. These numbers identify the location where the check was printed. The next four numbers are the ABA identifier. These numbers identify the financial institution such as Wells Fargo. The 9th number is known as the check digit. It is calculated via an algorithm and can be used to verify a check’s authenticity.

What are routing numbers used for?

Banks use routing numbers for all sorts of financial transactions. You might need one if you want to do any of the following:

- Set up a direct deposit, or pay bills automatically from your Wells Fargo account

- Have payments like a salary or pension deposited into your account

- Processing payments through a check

- Make a wire transfer or ACH payment to someone in the US

- Set up a savings account like Sofi Money or Betterment

- IRA transaction

- Prepaid cards

How to retrieve routing numbers on Wellsfargo’s website

Wells Fargo has a link that you can look up the routing number you needed. The downside is that you have to answer a series of questions which is time-consuming. On the same page, you can also find your account number.

Locating routing number on a personal check

Wells Fargo routing numbers by state

To send a domestic automatic clearing house (ACH) transfer, you’ll need to use the ACH routing number which differs from state to state

| State | Routing Number | State | Routing Number | |

| Alabama | 062000080 | New Hampshire | 121042882 | |

| Alaska | 125200057 | New Jersey | 021200025 | |

| Arizona | 122105278 | New Mexico | 107002192 | |

| Arkansas | 111900659 | New York | 026012881 | |

| California | 121042882 | North Carolina | 053000219 | |

| Colorado | 102000076 | North Dakota | 091300010 | |

| Connecticut | 021101108 | Ohio | 041215537 | |

| Delaware | 031100869 | Oklahoma | 121042882 | |

| District of Columbia | 054001220 | Oregon | 123006800 | |

| Florida | 063107513 | Pennsylvania | 031000503 | |

| Georgia | 061000227 | Rhode Island | 121042882 | |

| Hawaii | 121042882 | South Carolina | 053207766 | |

| Idaho | 124103799 | South Dakota | 091400046 | |

| Illinois | 071101307 | Tennessee | 064003768 | |

| Indiana | 074900275 | Texas | 111900659 | |

| Iowa | 073000228 | Texas – El Paso | 112000066 | |

| Kansas | 101089292 | Utah | 124002971 | |

| Kentucky | 121042882 | Vermont | 121042882 | |

| Louisiana | 121042882 | Virginia | 051400549 | |

| Maine | 121042882 | Washington | 125008547 | |

| Maryland | 055003201 | West Virginia | 121042882 | |

| Massachusetts | 121042882 | Wisconsin | 075911988 | |

| Michigan | 09110145 | Wyoming | 102301092 | |

| Minnesota | 091000019 | American Samoa | 121042882 | |

| Mississippi | 062203751 | North Mariana Islands | 121042882 | |

| Missouri | 121042882 | Puerto Rico | 121042882 | |

| Montana | 092905278 | Virgin Islands | 121042882 | |

| Nebraska | 104000058 | American Forces Abroad | 121042882 | |

| Nevada | 321270742 |

Routing numbers for wire transfers

| Type of wire transfer | Wells Fargo routing number |

|---|---|

| Domestic Wire Transfer | 121000248 |

| International Wire Transfer to Wells Fargo account in the USA | 121000248 |

| SWIFT Code | WFBIUS6S |

Final Thoughts

It’s important to use the right routing number for your transaction for obvious reasons. You can Google the needed number or use this post as your reference.

You’ll need to know if you’re performing an ACH domestic transfer or wire transfer because those numbers are different.

Please see the above charts for the needed routing numbers.

Sources: Millionaire Mob| Go Banking Rates| TransferWise|Credit Donkey